The Comprehensive Guide to Cryptocurrency Mining: Hardware, Profitability, and Market Dynamics

Cryptocurrency mining remains a vital pillar of the blockchain ecosystem, enabling secure transactions and network consensus. This guide details the core aspects of crypto mining, from specialized hardware and profitability factors to operational challenges and the evolving market landscape.

Crypto Mining Fundamentals

Crypto mining involves utilizing specialized hardware to solve complex computational problems that verify transactions and add new blocks to a blockchain. Miners are rewarded with cryptocurrency tokens, incentivizing the maintenance of blockchain integrity and security. This process underpins networks like Bitcoin, Kaspa, and others, employing diverse consensus algorithms to secure their ledgers.[1]

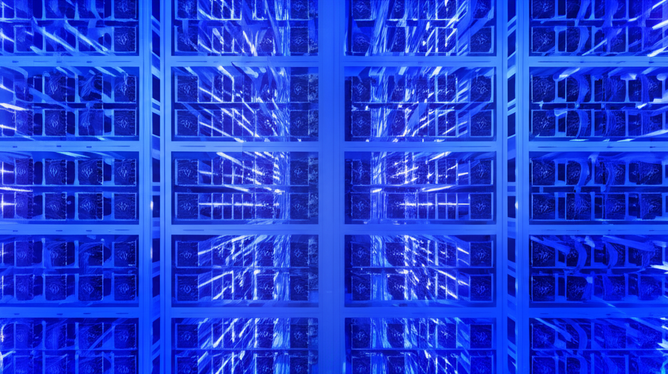

Hardware for Crypto Mining

ASIC Miners: The Backbone of Efficient Mining

Application-Specific Integrated Circuits (ASICs) represent the primary hardware choice for efficient crypto mining. These devices are engineered to perform specific mining algorithms with optimized speed and power efficiency.

Popular ASIC manufacturers include Bitmain, Canaan, MicroBT, and IceRiver, each offering models tailored to various cryptocurrencies:

- Bitcoin (SHA-256): ASICs like the Bitmain Antminer series dominate due to their high hash rates and energy efficiency.

- Kaspa (kHeavyHash): Specialized ASICs enable effective mining aligned with Kaspa’s protocol requirements.

- Litecoin and Dogecoin (Scrypt): Scrypt ASICs cater to these coins that share the same hashing algorithm.

- Kadena (Blake2S): Dedicated ASICs designed for Kadena’s unique algorithm.

It’s important to note that Ethereum’s transition to Proof-of-Stake in September 2022 means traditional Ethash ASIC mining for Ethereum is no longer viable.[1]

Factors Influencing Mining Profitability

Mining profitability depends on multiple key variables:

- Cryptocurrency Price: Higher coin prices generally increase mining revenue.

- Mining Difficulty: Network difficulty adjusts to the total computational power, impacting mining rewards.

- Hardware Cost: The initial investment in ASIC equipment affects the break-even timeline.

- Electricity Cost: A major ongoing operational cost, where lower electricity rates substantially improve profitability.

- Mining Pool Fees: Participation in mining pools incurs fees but stabilizes income.

Due to the volatile nature of cryptocurrency markets, mining profitability can fluctuate significantly. Online calculators, such as those provided by ASICProfit, help estimate expected returns based on hash rates, power consumption, electricity costs, and coin prices.[2]

Operational Aspects and Challenges

ASIC miners produce considerable heat and noise during operation. To mitigate these challenges, miners use specialized enclosures or “miner boxes” that enhance cooling and reduce noise pollution. Some of these solutions, like those offered by MinerBoxes, provide weatherproofing for outdoor operations and can house multiple miners in an organized layout, improving operational efficiency.[3]

Market and Regulatory Landscape

Staying informed about cryptocurrency market conditions is essential for miners. Platforms such as CoinMarketCap provide real-time price data, market capitalization, and historical trends crucial for assessing mining viability.[5]

Environmental concerns due to crypto mining’s high energy consumption have attracted regulatory scrutiny worldwide. The landscape varies by region, influencing mining operations through legislation and energy policies.[6]

Key Takeaways

- Crypto mining relies on specialized ASIC hardware tailored to specific algorithms and cryptocurrencies.

- Ethereum’s shift to Proof-of-Stake ended Ethash ASIC mining for Ethereum.

- Profitability hinges on cryptocurrency prices, mining difficulty, electricity costs, hardware expenses, and pool fees.

- Operational challenges like heat and noise are addressed using miner boxes and cooling solutions.

- Mining remains subject to market volatility and evolving regulatory frameworks focused on environmental impact.

Call to Action

Interested in starting your crypto mining journey or upgrading your mining setup? Visit OneMiners for the latest ASIC miners, profitability tools, and expert resources to guide your investment and operational decisions.