Maximizing ASIC Mining Profitability: A Comprehensive Guide

Cryptocurrency mining, particularly with Application-Specific Integrated Circuit (ASIC) miners, continues to intrigue enthusiasts and investors alike. The dream of generating passive income by solving complex mathematical problems is appealing, but real success hinges on understanding the nuances of ASIC mining profitability. It’s more than just plugging in a machine; it requires a strategic approach, a keen eye on market dynamics, and an understanding of operational costs. This guide delves into the essential factors that determine whether your mining venture will be a lucrative one.

Understanding ASIC Mining Profitability Factors

Several critical elements converge to influence how profitable your ASIC mining operation will be. Neglecting any of these can significantly impact your bottom line, transforming potential gains into unexpected losses.

Hardware Efficiency and Initial Investment

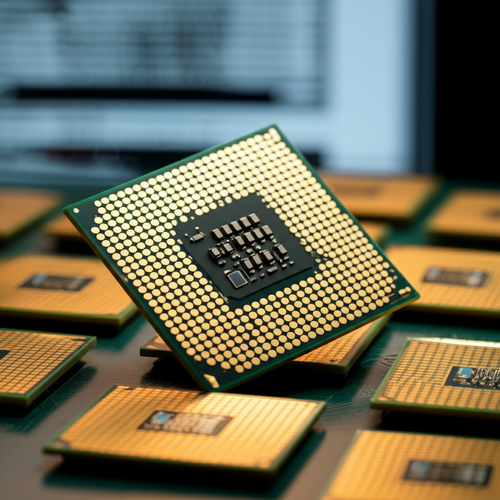

The upfront cost of an ASIC miner is a major barrier to entry, but it’s an investment that directly correlates with potential returns. Modern ASIC miners are designed for specific algorithms (e.g., SHA-256 for Bitcoin) and boast impressive hash rates (tera-hashes per second, TH/s). More importantly, their efficiency, measured in Joules per Terahash (J/TH), dictates how much cryptocurrency they can mine relative to the power they consume. Investing in more efficient hardware, even if pricier, can lead to lower energy bills and quicker ROI. Platforms like IceRiver EU often showcase various models, allowing miners to compare specifications and make informed decisions.

Energy Costs

Electricity is arguably the most significant ongoing expense for any mining operation. Profitability models must account for your local electricity rates, which vary wildly by region. A miner that is profitable in an area with low-cost hydropower might be a net loss in a city with high industrial rates. Careful calculation of power consumption (watts) multiplied by your electricity cost per kilowatt-hour (kWh) is essential for an accurate profitability forecast. This factor alone can make or break a mining venture.

Cryptocurrency Price Volatility

The value of the cryptocurrency you mine (e.g., Bitcoin, Litecoin) directly impacts your revenue. The crypto market is notoriously volatile, with prices fluctuating rapidly based on global news, regulatory changes, and investor sentiment. A sudden drop in value can quickly erode profits, while a surge can dramatically increase them. Staying informed about market trends, perhaps through financial news outlets like Yahoo News, is crucial for timely decision-making, such as when to sell mined coins or whether to expand operations.

Network Difficulty

As more miners join a cryptocurrency network, the “difficulty” of mining a block increases. This mechanism ensures a consistent block reward schedule. Higher difficulty means your ASIC miner, even with the same hash rate, will earn fewer coins over time. This factor is constantly adjusting and can significantly impact long-term profitability projections. Miners often discuss these shifts and their implications on forums, providing real-time insights into the competitive landscape.

Real-World Applications and Case Studies

Understanding theoretical factors is one thing; seeing them in action is another. Real-world experiences from the mining community offer invaluable lessons and practical insights into maximizing ASIC mining profitability.

Community Insights and Shared Experiences

Online communities are a treasure trove of practical advice. Forums like One Miners on Reddit are excellent places to find discussions on specific miner performance, optimal settings, troubleshooting, and even success stories or cautionary tales. Miners share their electricity bills, hash rates, and daily earnings, providing a transparent look at what’s truly achievable. These platforms facilitate knowledge exchange, allowing new miners to learn from veterans and make more informed decisions about equipment and strategies.

Hardware Showcases and Profit Demonstrations

Social media platforms are often used by mining businesses and individual enthusiasts to showcase their setups and demonstrate profitability. Accounts like ASIC Profit on Instagram frequently display various ASIC models in operation, highlighting their efficiency and the resulting daily earnings. These visual examples can help prospective miners visualize their own potential setups and understand the scale of operations, from small home setups to larger mining farms. They also provide a glimpse into the physical demands and environmental considerations of operating such powerful machines.

Future Trends and Sustainability in ASIC Mining

The cryptocurrency mining landscape is not static. Innovations, regulatory pressures, and environmental concerns are constantly shaping its future, directly impacting profitability.

Green Mining Initiatives

With increasing scrutiny on energy consumption, the future of ASIC mining is leaning heavily towards sustainability. Miners are exploring renewable energy sources like solar, wind, and hydro power to reduce their carbon footprint and operational costs. Projects focused on using waste energy or establishing mining operations in cold climates for efficient cooling are gaining traction. This shift not only addresses environmental concerns but can also offer long-term cost savings, making mining more resilient to fluctuating energy prices. Discussions on green mining practices are becoming more prevalent across various news and social media platforms, including X (formerly Twitter).

Regulatory Landscape

Governments worldwide are grappling with how to regulate cryptocurrency and mining operations. Policies can range from outright bans to supportive frameworks that offer tax incentives for miners. Regulatory decisions can significantly impact the legality, operational costs, and overall viability of mining. Staying abreast of global and local policy developments, often reported by major news outlets, is crucial for anticipating future challenges and opportunities in the mining sector.

Actionable Takeaways for Aspiring Miners

For those considering entering the ASIC mining space, here are some actionable steps to maximize your chances of profitability:

- Thorough Research: Before purchasing any hardware, conduct extensive research on miner specifications, current market prices, and community reviews.

- Calculate Costs Meticulously: Obtain precise electricity rates for your location and factor in all initial investment costs, including shipping, customs, and setup.

- Monitor Market Conditions: Stay informed about cryptocurrency price movements and network difficulty adjustments. Use reliable sources for market data.

- Join Mining Communities: Engage with online forums and groups. The shared knowledge can save you from common pitfalls and provide valuable operational tips.

- Consider Energy Efficiency: Prioritize miners with higher J/TH efficiency ratings to minimize ongoing electricity costs.

- Plan for Volatility: Have a strategy for when to sell your mined coins. Don’t rely solely on immediate high prices; consider dollar-cost averaging your sales.

Conclusion

ASIC mining profitability is a dynamic equation influenced by hardware, energy, market conditions, and community knowledge. While the allure of cryptocurrency mining is strong, success demands diligent research, strategic planning, and continuous adaptation to an ever-evolving landscape. By understanding and proactively managing these key factors, both new and experienced miners can significantly enhance their potential for a profitable venture in the exciting world of digital asset creation.