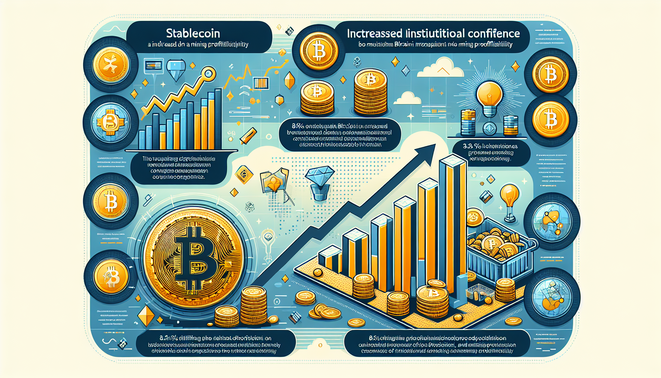

Stablecoin Talks, BlackRock Sells, Bitcoin Volatility As the crypto landscape evolves, policymakers, institutional players, and market forces are converging in new and impactful ways. From the latest discussions on stablecoin regulation in the White House to BlackRock’s sizable Bitcoin and Ethereum sell-off ahead of major options expirations, and Bitcoin’s knee-jerk reaction to a Supreme Court […]